Bauxite Recap 2019: New mining projects and expansions boosted production and shipments, while prices remained sluggish

The year 2019 saw an increasing production of bauxite across the globe, bolstered by expansions in mining and also some of the new projects such as EGA’s first bauxite project in Guinea, Rio Tinto’s commissioning of Amrun bauxite mine, and the beginning of mining and screening operations at Australian Bauxite Limited’s Bald Hill mine. But due to the surplus production, the global price of the ore remained sluggish, which on the other hand, helped in boosting China’s bauxite imports. As a consequence to this, the demand and use of China’s domestic bauxite ore remained sluggish and the price followed a downtrend throughout the year.

Let us recapitulate the bauxite market of 2019 in more details, starting with the price trend, followed by projects, production, and shipments.

Price trend inside and outside China

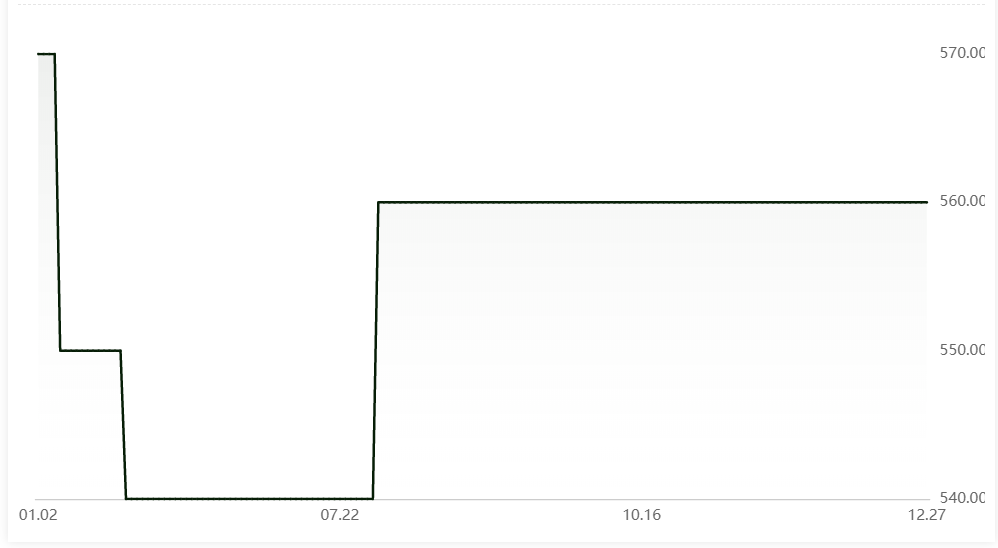

Throughout the year, the bauxite price in China continued a lower trend, although range-bound between RMB 570 per tonne and RMB 540 per tonne. Until June 30, the price declined over the months from RMB 570 per tonne to RMB 540 per tonne, which since June 31, inched up and clocked at RMB 560 per tonne until December 29. In the first half of the year, the domestic price remained sluggish as there was a weak consumption and demand due to increasing supply of overseas bauxite, as the price of the latter was low. Moreover, constructions halt at some of the bauxite mining project in China supressed the domestic supply, resulting in more consumption of the imported bauxite. For instance, State Power Investment Corporation Shanxi Aluminium’s bauxite mining project which had started in 2010 was on halt for about a decade, but finally recommenced on April 20 of this year.

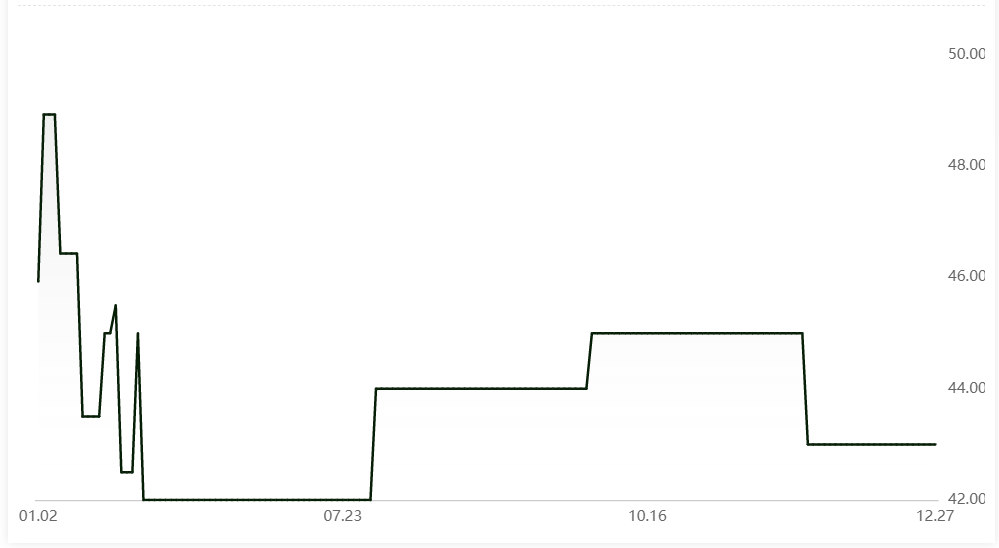

Meanwhile, the supply of overseas ore increased, as the price was low at US$45.93 per tonne to US$ 43 per tonne throughout the year. Commencement of several bauxite projects in Australia, one of the primary suppliers of the ore to China, contributed to the increasing import to the country. Australian Bauxite Limited began mining and screening operations at its Bald Hill mine near Campbell Town, northern Tasmania, while Rio Tinto completed commissioning of the Amrun bauxite mine in Queensland, Australia.

Other projects and expansions boosting bauxite supply in China

Emirates Global Aluminium recently signed an agreement to supply Xinfa with bauxite from its Guinea Alumina Corporation mine for the next five years. It will supply the Chinese company with millions of tonnes of bauxite each year from 2020, with the first vessel scheduled to load in January. EGA’s Guinea Alumina Corporation (GAC ) project is expected to mine approx. 12 million tonnes of bauxite per year.

Metro Mining, on the other hand, geared up its production this year after the end of the wet season in Australia from November 2018 to April 2019. The primary target of Metro Mining in 2019 was to meet the increasing demand of bauxite from China, which was expected to grow from 82 million tonnes last year to 90 million tonnes. The company had even signed a new binding contract with a major state-owned Chinese Aluminium Group to deliver 420,000 WMT (wet metric tonnes) of bauxite in H2 2019.

Up until November 30, Metro Mining’s total bauxite production and shipment amounted to 3.231 million WMT and 3.218 million WMT respectively, close to the entire year guidance of 3.3 million to 3.5 million wet metric tonnes at its Bauxite Hills.

Production scene

The bauxite production in Australia this year was estimated to come in at 117.3 million tonnes in 2019-20, up from 80.3 million tonnes in 2014-15, according to a market research report.

BMI research report had also projected a positive trend in India’s bauxite output. According to its data, the production of the ore in India is like to growth 49.4 million tonnes by 2021 from 22.08 million tonnes in 2016, averaging an annual growth rate of 17.5 per cent. The growth is projected due to the five-fold increase in mining lease area in Odisha, the report said.

According to a recent report, Nalco is aiming to put on stream its second bauxite mining lease of Pottangi by 2023, in a bid to extend the longevity of alumina refining and aluminium smelting operations. This captive mine will feed its fifth stream of alumina refinery at Damanjodi currently under expansion. The Pottangi mining lease along with the Panchpatmalli mines having balance deposits of around 160 million tonnes (mt) would offer ample bauxite to ensure the refinery operations for the next 25 to 30 years.

The public hearing on this was scheduled on December 17, where thousands of villagers around Pottangi block amicably supported the project and thus, the company was allotted the Pottangi bauxite mines in Koraput district. The Pottangi bauxite mine will have a production capacity of 3.5 MTPA.

The bauxite mine of National Aluminium Company Ltd (NALCO) also bagged the coveted ‘Golden Peacock Environment Management Award’ for the year 2019 for setting global benchmarks in Environmental Management.

Rusal’s bauxite production in Q3 2019 declined by 6.9 per cent from 4,242 thousand tonnes in Q2 2019 to 3,948 thousand tonnes. However, in the first nine months of the year, the company produced 12,021 thousand tonnes of bauxite, compared with 10,128 thousand tonnes during the same period last year, meaning the output grew 18.7 per cent year-on-year in the nine months of 2019.

Rio Tinto’s third quarter bauxite production stood 9 per cent higher than the same period of 2018, with increased production across all sites. Production came in at 13.79 million tonnes, up 3% quarter-on-quarter.

Sneak-peak to trade focus

Guinea has been the leading bauxite exporter over the years and this year is not an exception. According to the global trade data, the country’s bauxite export in 2019 is expected to come in at 64 million tonnes, in compare to an approximate export volume of 56 million tonnes in 2018, and the revenue US$622 million. Moreover, in the beginning of the year, EGA’s first bauxite train travelled from its subsidiary Guinea Alumina Corporation’s (GAC) mine to the coast, carrying some 6,800 tonnes of bauxite.

To China, the country shipped 27.6 million tonnes of bauxite in the first half of 2019, accounting for 52.5% of total Chinese imports and marking a year-on-year increase of 36.6% from 20.2 million tonnes. The price for bauxite, fob Kamsar, Guinea, averaged $37.20 per dry metric tonne unit during the same period of 2019.

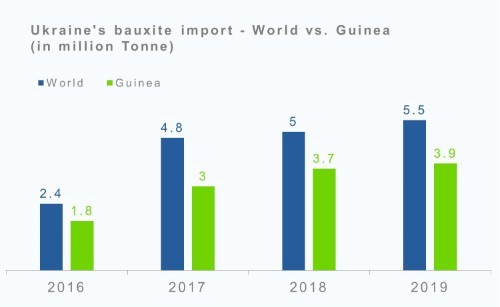

Ukraine, which is Guinea’s another leading bauxite export destination, is expected to secure 5.4 per cent more of bauxite this year from the year last amounting to 3.9 million tonnes, out of its total import of 5.5 million tonnes. The cost is expected to come in at US$226 million, up 9.17 per cent year on year.

Besides Guinea, China imports a lion share of bauxite from Australia and Indonesia as well. In November, Australia exported 3.28 million tonnes of bauxite, while in October 3.5 million tonnes after recording an increase of 5.03% month-on-month and 30.53% year-on-year, as the export volume in October was 3.33 million tonnes. In August, Australia’s export to China had clocked at 3.63 million tonnes.

Indonesia in November exported 1.5 million tonnes of bauxite to China, while in October 1.08 million tonnes and in August and September 1.13 million tonnes and 1.21 million tonnes, respectively.

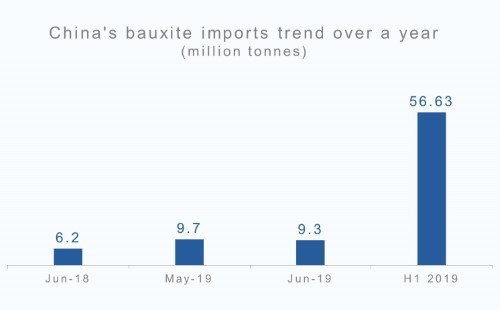

In the first half of the year, The Republic of Guinea, Australia and Indonesia together accounted for 93.7% of China’s total bauxite imports, which were 56.63 million tonnes, up 39.26 per cent YoY.

In the second half until November, China’s total bauxite imports were 29.48 million tonnes, which shows a downtrend in its imports compared to that in the first half of the year.

The United States bauxite imports in Q2 2019, according to the USGS data, increased 38 per cent from Q1 2019 and 13 per cent from the same period last year to 1.03 million tonnes. This brought the United States total bauxite imports in the first half of 2019 to 1.77 million tonnes.

Outlook:

If the downtrend in China’s bauxite imports prevails in 2020, then there could be a rise in the demand and use of the domestic ore, resulting in the boost in prices. Meanwhile, China’s aluminium industry is looking at Guizhou as a potential hub of bauxite as a number of bauxite mines have been closed down in Central China's Henan and North China's Shanxi provinces for environmental reforms. Guizhou has about 162 million tonnes of bauxite deposits, about 18 per cent of the country's total and ranking fourth after Shanxi, Henan and the Guangxi Zhuang autonomous region.

On the global front, according to a report from Consultancy group Fitch Solutions, Australia is set to drive growth in the global bauxite sector, currently holding 12 of the 29 new bauxite projects. Rio Tinto’s US$2.6 billion Amrun project in Queensland is going to further strengthen Australia’s position as the world’s top bauxite producer.

Guinea is with the next highest number of new projects, according to Fitch. The country is reportedly holding seven new bauxite projects, which will expectedly boost production from 59 million tonnes in 2018 to 82.3 million tonnes by 2028. Also, in Indonesia, bauxite production is estimated to grow at an annual average of 8.1 per cent during 2019-2028, with the output 11.6 million tonnes by 2029 from 6.5 million tonnes this year.

source https://www.alcircle.com/news/bauxite-recap-2019-new-mining-projects-and-expansions-boosted-production-and-shipments-while-prices-remained-sluggish-49711

Comments

Post a Comment