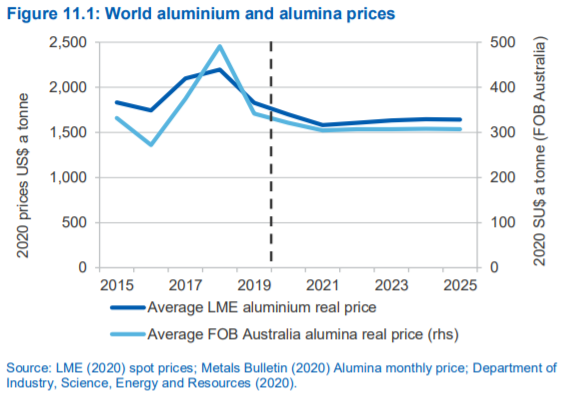

Not even a month or two went by this year, the aluminium industry started facing a brand new challenge in the form of COVID19, followed by some of the severe impacts at its prices, demand, and consumption in the year last due to the US-China trade tensions, US aluminium import tariffs, and the world economic slowdown. The London Metal Exchange spot price for aluminium in 2019 had fallen by 17 per cent to average US$1,830 per tonne, and that of the free on board (FOB) Australian alumina price declined to US$342 per tonne, driven by rising supply with the return of Brazil’s Alunorte refinery to full production. In 2020, the LME aluminium spot price is forecast to decrease further, but slower than the year last, by 7.1 per cent to average US$1,699 per tonne, and that in 2021 by another 7 per cent to US$1,581 per tonne.

Outlook for 2020 & 2021

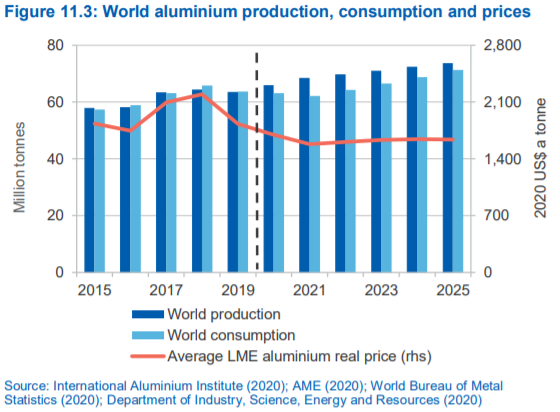

The estimated fall in prices in the next two years reflects the combination of growing aluminium production and weaker aluminium consumption. The production over the outlook period is projected to increase at an annual average rate of over 2.5 per cent, while consumption to decrease at an average rate of 1.2 per cent a year.

In 2020, the aluminium production is estimated to come in at 66 million tonnes and in 2021 69 million tonnes, in contrast to the consumption of 63 million tonnes in 2020 and 62 million tonnes in 2021. As a consequence, build-up of aluminium stocks is expected in the short term.

The COVID19 outbreak is expected to reduce the aluminium demand in China, which accounts for 57 per cent of the global aluminium consumption, by 2.5 per cent in 2020.

Adding further pressure to aluminium prices is the impact of falling input costs, with alumina prices forecast to continue declining through the outlook period. The Australian FOB alumina price is forecast to fall by 5.9 per cent to average US$322 per tonne in 2020, and then to US$305 per tonne in 2021.

Slowing demand growth from the world automotive sector may also aggravate the impact on global aluminium demand and prices in 2020 and 2021.

Outlook for post 2021

After 2021, the LME aluminium spot price is projected to rise at an annual rate of 0.9 per cent to average US$1,640 per tonne in 2025, backed on the recovery of Chinese aluminium consumption.

Global aluminium consumption is forecast to grow at an annual rate of 3.5 per cent to reach over 71 million tonnes in 2025, amidst the rising demand rate of 1.2 per cent in 2020 and 2021. For 2022, the consumption is estimated at 64 million tonnes, 2023 67 million tonnes, 2024 69 million tonnes, and 2025 71.3 million tonnes.

Production of the primary metal is also projected to record a hike of 2.3 per cent a year between 2021 and 2025. For 2022, the output is estimated at 70 million tonnes, 2023 71 million tonnes, 2024 72 million tonnes, and 2025 74 million tonnes. Additional capacity in China, Iran and Indonesia is likely to be the cause for the gain in production. In China, more Greenfield aluminium smelters are anticipated, located in regions such as Yunnan province where power is cheap and abundant. Outside of China, Iran is implementing a plan to increase its annual aluminium production to 1.5 million tonnes by 2025.

The Australian alumina FOB price is projected to increase at 0.2 per cent a year to US$307 per tonne in 2025, bolstered by the estimated growth in world alumina production by 1.5 per cent. World alumina consumption is likely to rise at an average annual rate of 1.2 per cent, reaching nearly 126 million tonnes by 2025.

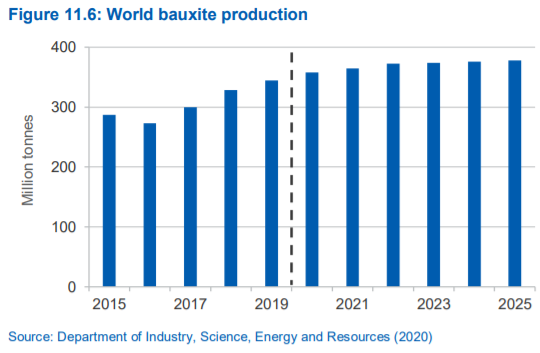

World bauxite consumption is projected to grow at an average annual rate of 1.8 per cent over the next five years, reaching 337 million tonnes by 2025, primarily driven by new alumina capacity in China and Indonesia. The production of the input is projected to grow at an average annual rate of 1.2 per cent, reaching 376 million tonnes by 2025. The gains are expected to be driven by newly added capacity in Australia and Guinea, where production is rising rapidly. The Compagnie des Bauxites de Guinée (CBG) mine in Guinea, which expanded from 13 to 18 million tonnes per annum in 2019, is due to expand to 28 million tonnes per annum by 2022.

source https://www.alcircle.com/news/world-aluminium-outlook-amid-covid19-production-to-grow-at-a-cagr-2-3-during-2021-25-54557

Comments

Post a Comment