LME aluminium price shrinks by US$20.50/t following the highest jump ever; SHFE price downtrends to US$2651/t

Three-month LME aluminium fell 2.77 per cent to close at US$ 2157 per tonne on Friday, with open interest rising to 707,000 lots. It is expected to trade between US$ 2050-2250 per tonne today. The influence of overseas macro liquidity and guiding indicators such as US dollar index and crude oil on LME metals should continue to be monitored.

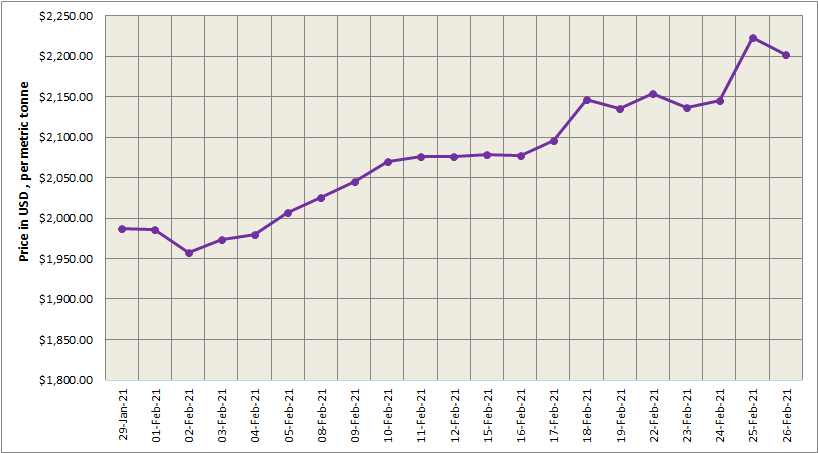

LME aluminium cash (bid) price and LME official settlement price decreased by US$ 20.50 per tonne to close the week at US$ 2202.50 per tonne on Friday, February 26. 3-months bid price and 3-months offer price stood at US$ 2202.50 per tonne as well, declining US$ 24.50 per tonne from US$ 2227 per tonne. Dec 22 bid price and Dec 22 offer price hovered around US$ 2250.50 per tonne compared with US$ 2272.50 per tonne on February 25.

The LME aluminium opening stock decreased from 1332525 tonnes on Thursday to 1325875 on Friday. Live Warrants totalled 1099850 tonnes, while Cancelled Warrants stood at 226025 tonnes.

LME aluminium 3-months Asian Reference Price further decline from US$ 2230.26 per tonne on February 25 to US$ 2215.17 per tonne on February 26.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE opened the week on Monday, March 1, with a further downturn of US$ 14 per tonne to stand at US$ 2651 per tonne.

The most-liquid SHFE 2014 aluminium contract dropped 2.26 per cent to settle at RMB 17,070 per tonne on Friday night, and is likely to trade between RMB 16,850-17,250 per tonne today. It is expected that the contract will still fluctuate at high in the near term.

source https://www.alcircle.com/news/lme-aluminium-price-shrinks-by-us20-50-t-following-the-highest-jump-ever-shfe-price-downtrends-to-us2651-t-62624

Comments

Post a Comment