Recap 2020: Slowdown in production activities due to COVID19 let down primary aluminium demand & prices; Recovery began in H2

The first half of 2020 experienced a steady drop in primary aluminium prices worsened by falling demand for the metal due to the COVID19 pandemic. Slowdown in global economy caused by the unprecedented crisis touched upon almost all the industrial sectors, including automobile, construction, and aerospace, resulting in a downturn in global demand and consumption of aluminium. According to a data showed by the Norwegian aluminium producer Norsk Hydro, world primary aluminium consumption fell 9.41 per cent year-on-year in H1 2020 from 32.237 million tonnes to 29.203 million tonnes. But at the same time, primary aluminium production remained steady, causing a surplus in the market. However, the gradual recommencement of production activities in various industrial sectors from the third quarter of the year lifted the market condition. So, here is a quick look at how the primary aluminium industry moved in the entire 2020 and what is expected in near future.

Production & Consumption

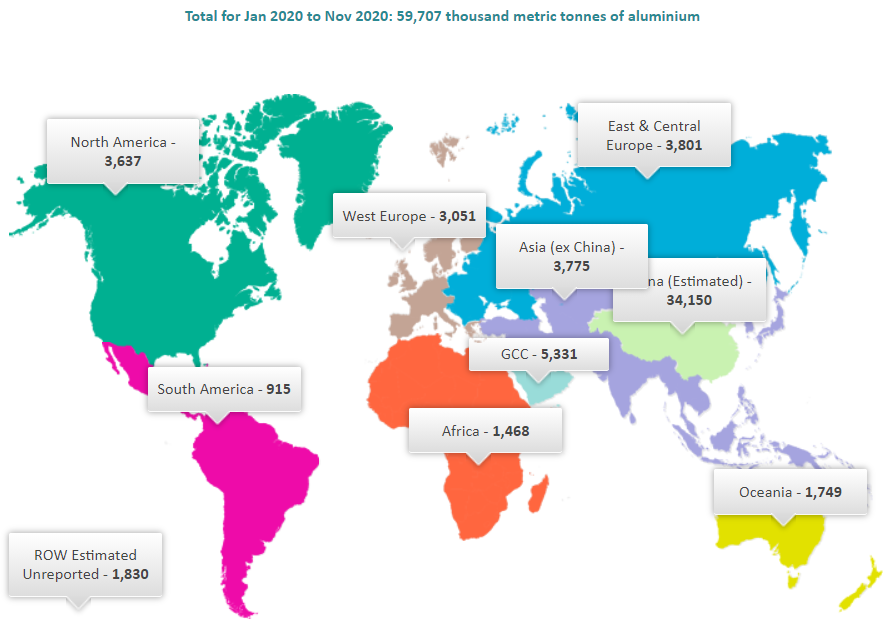

During January-November 2020, world primary aluminium production stood at 59.707 million tonnes compared to 58.218 million tonnes during January-November 2019. This represents an increase of 2.58 per cent in production globally, according to the data released by the International Aluminium Institute. China, being the world’s leading primary aluminium producer, churned out 34.150 million tonnes in the first eleven months of the year, 4.27 per cent more than 32.751 million tonnes during the corresponding period last year.

World Primary Aluminium Production: IAI

Data from the National Bureau of Statistics (NBS) showed China’s primary aluminium production in November grew 8.7 per cent year-on-year to 3.18 million tonnes, with daily output hit a record high 106,000 tonnes outperforming September’s record of 105,433 tonnes. China’s aluminium production was on the upswing even when the country imported the highest volume of primary aluminium in a decade in May 2020 due to an open arbitrage to London Metal prices, which made it cheaper to purchase overseas metal.

In the Middle East, primary aluminium production increased by 3.55 per cent year-on-year from 5.148 million tonnes to 5.331 million tonnes during January-November 2020. The output in November this year stood at 478,000 tonnes.

World primary aluminium consumption in the second quarter of the year fell 9 per cent year-on-year as the coronavirus took its toll. Consumption reached 15.482 million tonnes in Q2 2020, down from 17.01 million tonnes in Q2 2019. Norsk Hydro estimated global aluminium demand to remain weak for the full year, leading to a significant supply surplus.

Inventory Situation

LME aluminium stocks started the year with 1.473 million tonnes, which by the year end dropped to 1.383 million tonnes.

In China, social inventories of primary aluminium ranged between 610,000 tonnes and 586,000 tonnes this year. Until the beginning of April 2020, Chinese primary aluminium inventories rose stupendously on narrow demand and consumption of the metal due to the onset of the COVID19 pandemic. As of the end of March, primary aluminium inventories in China stood as high as 1.664 million tonnes gaining more than 1 million tonnes in a couple of months. But with the growth in consumption and limited arrivals of stocks at warehouses, the inventories declined below 600,000 tonnes.

Demand Supply Analysis

Norsk Hydro said external sources estimated a surplus of between 3 million tonnes and 4.7 million tonnes in 2020, with both China and the rest of the world showing a surplus for the year. According to the latest production data released by Hydro, the company churned out 522,000 tonnes of primary aluminium in the third quarter of 2020. This brought Hydro’s total aluminium production in the first nine months of 2020 to 1.559 million tonnes, up by 4.42 per cent from 1.493 million tonnes during the same period last year. Going ahead Hydro’s primary aluminium production is likely to increase as Hydro Husnes B Line also resumed operation after remaining idle since 2009 due to a financial crisis. With the recommencement of Line B, Hydro Husnes will produce 195,000 tonnes of aluminium annually.

Bosnia’s ailing aluminium producer Aluminij also recommenced production after a halt for 15-months, thanks to an agreement with an Israeli-Chinese partner signed earlier this year. Aluminij plans to produce 3,000 tonnes of aluminium logs in the first two months after the restart of production.

Alcoa’s primary aluminium production in Q3 2020 stood at 559,000 tonnes compared to 530,000 tonnes during the same period last year. Alcoa’s total production in the three quarters came in at 1.704 million tonnes, up by 6.50 per cent from 1.600 million tonnes.

Rusal’s aluminium production in Q3 2020 totalled 939,000 tonnes, with Siberian smelters representing 93 per cent of total output.

NALCO in the second quarter of FY21 produced 1.06 lakh tonnes of aluminium and sold 58,574 tonnes compared to 16,305 tonnes in corresponding period last year. But despite the increase in primary aluminium production in India, more than 60 percent of India’s aluminium demand is met through imports, of which China contributes 16 per cent to the import basket of the metal. Other countries that supply the metal to India include the US, Malaysia, the UK & the UAE. In such background, Vedanta Limited aimed to increase its aluminium exports at a time imports comprise 60 per cent of India's consumption of the metal. In the present fiscal year, Vedanta has aimed to ship more than half of its production to international markets.

Given this situation, India’s primary aluminium producers like Hindalco and Vedanta are working with the government to bring down the country’s aluminium imports. They are seeking trade remedial measures like anti-dumping duty and anti-subsidy duty. According to the industry officials, the domestic aluminium industry is capable of substituting 100 per cent primary products and 50 per cent downstream products that are imported into India with its existing capacities.

However, in the first quarter of FY21, India’s primary aluminium demand plunged by about 45-50 per cent on-year due to the nationwide and local lockdowns to contain the COVID-19 pandemic, whereas production fell by just 5 per cent during the quarter. Rise in exports during the period helped manufacturers of the commodity tackle a sharp decline in domestic demand, said a report.

Price Analysis

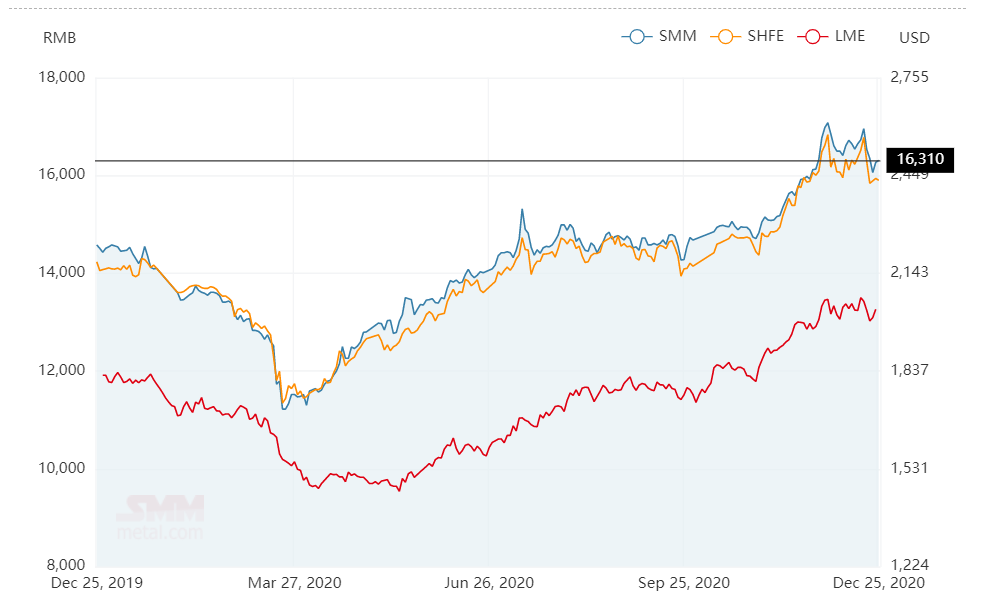

The shutdown of industrial production due to the COVID19 pandemic and concerns over a global economic slowdown led to falling demand and plunging aluminium prices in the first half of 2020. The fall in prices was further driven by excess supply of the metal. The benchmark price of aluminium on the London Metal Exchange started the year at US$ 1772 per tonne but edged lower through the first half of 2020 to US$ 1602 per tonne. The bearish trend continued through July as well until the LME aluminium price started recovering in August. It was only in October when the price started exceeding the maiden price of the year to grow above US$ 1800 per tonne. On November 30, the LME aluminium price even surpassed US$ 2000 per tonne. The highest LME price this year was US$ 2051.50 per tonne on December 2. The global price recovered when demand for the metal started growing with the recommencement of production activities.

Primary Aluminium Price on LME & SMM

China’s aluminium price also stood bullish through the first half of the year but it began recovering slowly after March. Starting at US$ 2,234.31 per tonne, China’s aluminium spot price shrank to as low as US$ 1791.41 per tonne, as of March 23. Till early July, China’s aluminium price remained below the maiden price of the year ranging from US$ 1,736.32 per tonne to US$ 2,217.52 per tonne. On July 13, the price stood at US$ 2,347.71 per tonne, higher than the maiden price, but again slipped to US$ 2,188.34 per tonne, as of September 25. From October the price started growing to surpass US$ 2500 per tonne. On December, China’s aluminium spot price reached the highest of the year at US$ 2,617.42 per cent.

Short term outlook

Aluminum is expected to again be in substantial surplus in 2021, with new primary aluminium capacity coming up in China. China Hongqiao Group Limited has already initiated the first phase of production at a greener aluminium plant in the southwestern province of Yunnan. The first phase of the project has a production capacity of 1 million tonnes per year, according to Hongqiao.

The Phase I electrolytic tanks of Wenshan Aluminium’s 500,000 tonnes per year aluminium smelting and hydropower project in Yunnan province has also come online this year. The Phase I capacity contains 62 electrolytic tanks, which are 500KA new integrated prebaked anode aluminium electrolytic cells.

China’s Henan Shenhuo Group is expected to start production at the second phase of its 900,000 tonnes per year aluminium project by the first quarter of CY2021. The second phase of the project, located in Wenshan prefecture in Yunnan province, will be having a capacity of 450,000 tonnes per annum.

In addition, China will add another 3 million tonnes of annual aluminium production capacity in 2021 – more than half the capacity in the emerging smelting hub of Yunnan province, said Antaike in October 2020. Analyst Wang Hongfei said at the China International Aluminum Week conference in Chongqing that Antaike sees 1.88 million tonnes of capacity coming on stream in Yunnan next year, following 1.63 million tonnes of capacity in 2020.

Antaike also expects 370,000 tonnes of capacity to come online in Guangxi, 550,000 tonnes in Inner Mongolia, and 100,000 tonnes in Shanxi and Guizhou in 2021.

From 35.93 million tonnes of primary aluminium production in 2019, the output is expected to increase to 37.15 million tonnes by the end of 2020 and to 38 million tonnes by 2021.

By next year, primary aluminium consumption in China is estimated to rise by 1.7 per cent, following a projected hike of 1.6 per cent in consumption in 2020. It is also estimated by Antaike that China’s net primary aluminium imports will stand at 820,000 tonnes this year.

Besides, Hydro stated that it would emphasis on the production of low-carbon aluminium. Hilde Merete Aasheim, President and CEO of Hydro, said: “We have generated cash, cut costs and delivered extensive operational improvements across the company, providing a solid foundation for our growth agenda.”

source https://www.alcircle.com/news/recap-2020-slowdown-in-production-activities-due-to-covid19-let-down-primary-aluminium-demand-prices-recovery-began-in-h2-62063

_0_0.jpg)

Comments

Post a Comment