Three-month LME aluminium closed higher at $1613/t for the second consecutive session; SHFE hiked to $1977/t

The US dollar started the week on a negative footing and edged lower on Monday. Market sentiment was lifted as the European Union is preparing to open its borders to travellers from 14 countries after months of lockdown.

Three-month LME aluminium closed higher for the second consecutive session, ending at US$ 1,613 per tonne, up 0.97 per cent on the day.

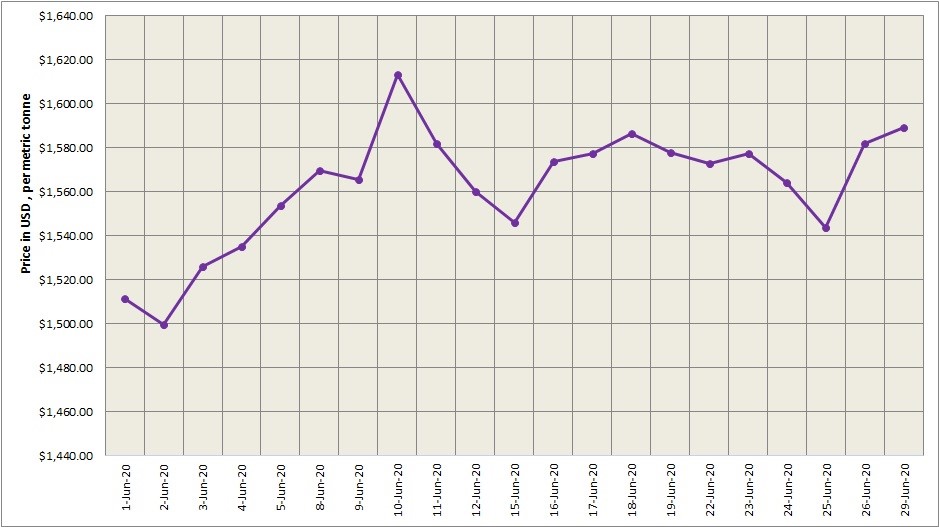

As of Monday, June 29, LME aluminium cash (bid) price and LME official settlement price increased from US$ 1582 per tonne to US$ 1589 per tonne. 3-months bid price and 3-months offer price stood up by US$ 9.5 per tonne to US$ 1607 per tonne. Dec 21 bid price and Dec 21 offer price came in at US$ 1706.50 per tonne compared to US$ 1699 per tonne on Friday, June 26.

The LME aluminium opening stock totalled 1648000 tonnes. Live Warrants stood at 1472775 tonnes, while Cancelled Warrants 175225 tonnes.

LME aluminium 3-months Asian Reference Price hovered at US$ 1605.5per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE hiked to US$ 1977 per tonne on June 30 from US$ 1958 per tonne on June 29.

The most-liquid SHFE contract advanced 1.1 per cent to end at RMB 13,775 per tonne, shortly after notching a session-high of RMB 13,795 per tonne.

The most-active SHFE August contract trimmed some increase after it advanced to a session high of RMB 13,795 per tonne, finishing higher on the day at RMB 13,775 per tonne. It is expected to trade between RMB 13,600-13,900 per tonne today with spot premiums at high levels amid tight supply.

source https://www.alcircle.com/news/three-month-lme-aluminium-closed-higher-at-1613-t-for-the-second-consecutive-session-shfe-hiked-to-1977-t-57267

Comments

Post a Comment