The US dollar rebounded against major currencies and riskier emerging market units on Monday, snapping a week of declines as investors braced for prolonged uncertainty and governments tightened lockdowns and launched monetary and fiscal measures to fight the coronavirus pandemic.

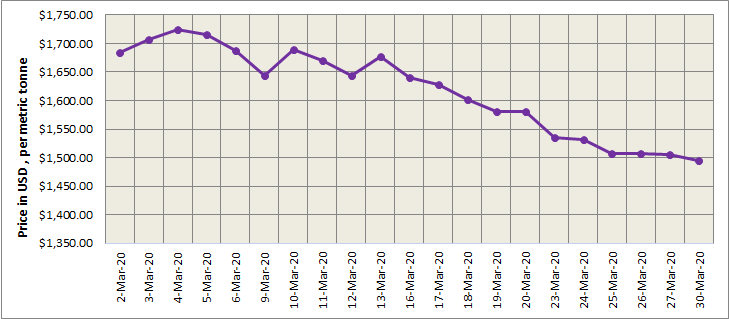

Three-month LME aluminium resumed its downtrend on Monday, slipping to its lowest since April 2016 at US$ 1,522 per tonne in North American trading hours before closing the day sharply lower at US$ 1,529 per tonne. It is expected to move range-bound at US$1,520-1,570/per tonne today.

As of Monday, March 30, both LME aluminium cash (bid) price and LME official settlement price stood at US$ 1495 per tonne after inching down by US$ 11 per tonne from US$1506 per tonne. 3-months bid price and 3-months offer price slipped to US$ 1528 per tonne from US$ 1538.50 per tonne, while Dec 21 bid price and Dec 21 offer price stood at US$ 1652 per tonne.

The LME aluminium opening stock stood at 1150775 tonnes. Live Warrants totalled 994000 tonnes, and Cancelled Warrants 156775 tonnes.

LME aluminium 3-months Asian Reference Price hovered at US$ 1532.09 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE dipped marginally from US$ 1629 per tonne to US$ 1628 per tonne, as of Tuesday, March 31.

The most-liquid SHFE May contract declined as virus fears dampened the morale of longs, which departed and sent the contract down 1.45 per cent on the day to finish at RMB 11,515 per tonne. SMM data showed that social inventories of primary aluminium declined over the weekend, as downstream producers in Guangdong restocked on low inventories. However, it remains to be seen whether inventory draw will continue as export orders shrank on the virus impact.

The most-active SHFE 2005 contract is trading at RMB 11,250-11,820 per tonne. East China spot discounts are seen slightly narrower at RMB 90-70 per tonne against the SHFE 2004 contract, as the 2004-2005 spread flips into backwardation on expectations of tax cuts.

source https://www.alcircle.com/news/lme-aluminium-price-declined-by-11-t-to-stand-at-1506-t-shfe-dipped-marginally-to-1628-t-53405

Comments

Post a Comment