The US dollar index was little changed on Wednesday as coronavirus headlines sapped sentiment.

The dollar index, which tracks the greenback against a basket of other currencies, edged up 0.14% and ended at 99.12. LME base metals fell for the most part. LME aluminium went flat.

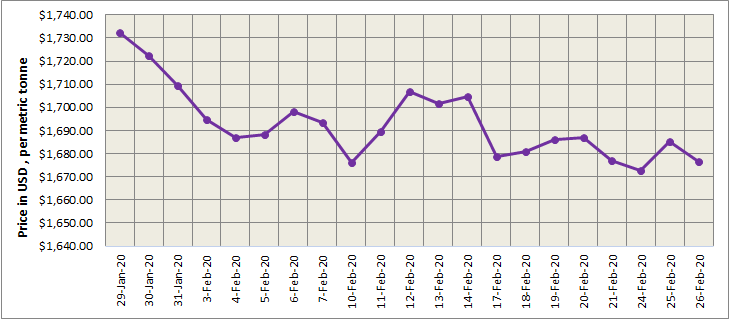

Three-month LME aluminium ended at US$1,702 per tonne after slipped to a session low of US$1,690 per tonne. LME aluminium inventories extended their slide, which coupled with better-than-expected US new home sales data, underpinned aluminium prices. The contract is likely to trade between US$1,680-1,720 per tonne today.

As on Thursday February 26, LME aluminium cash (bid) price stands at US$ 1676 per tonne, LME official settlement price stands at US$ 1676.5 per tonne; 3-months bid price stands at US$ 1696 per tonne, 3-months offer price is US$ 1698 per tonne; Dec 21 bid price stands at US$ 1825 per tonne, and Dec 21 offer price stands at US$ 1830 per tonne.

The LME aluminium opening stock dropped to 1103575 tonnes. Live Warrants totalled 791850 tonnes, and Cancelled Warrants were 311725 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1700.33 tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE increased to US$1911 per tonne on Thursday, 27 February 2020.

The most-active SHFE 2004 contract closed the day 0.07% weaker at RMB13,490 per tonne. SHFE aluminium is expected to remain weak as consumption recovers slowly. The contract is expected to trade at RMB13,400-13,700 per tonne.

source https://www.alcircle.com/news/three-month-lme-aluminium-ended-at-us1702t-shfe-aluminium-to-remain-weak-in-the-short-term-52174

Comments

Post a Comment