Chinese primary aluminium inventories trending higher W-o-W amidst weaker demand in compare to production

According to Shanghai Metals Market, the social inventories of primary aluminium in China have continued to trend higher this week, as demand has recovered slowly than expected.

The SMM data shows, the inventories have built up by 155,000 tonnes over the week across eight major consumption areas, including SHFE warrants, to come in at 1.385 million tonnes, as of Thursday, February 27. On last Thursday, February 20, the inventories stood at 1.23 million tonnes after increasing by 137,000 tonnes from the previous week.

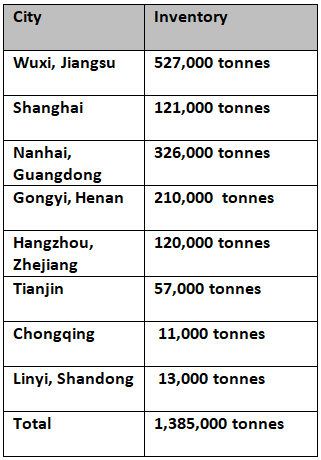

The below chart indicates the current status of primary aluminium inventories across China in more details:

In Wuxi, Shanghai, and Nanhai, the inventories have increased by 80,000 tonnes, 10,000 tonnes, and 68,000 tonnes week-on-week to stand at 527,000 tonnes, 121,000 tonnes, and 326,000 tonnes, respectively. Hangzhou, Gongyi, and Linyi have seen a rise of 5,000 tonnes and 1,000 tonnes to 125,000 tonnes, 209,000 tonnes, and 13,000 tonnes, while Tianjin and Chongqing have witnessed restraint at 57,000 tonnes and 11,000 tonnes, respectively.

Slow recovery in demand among the downstream aluminium sector while continued production at smelters amidst Coronavirus could primarily be attributed to the continuous growth in primary aluminium inventories and drop in prices, as a result.

Today, the A00 aluminium ingot price has declined by RMB 40 per tonne to RMB 13,390 per tonne. With this, the ingot price stands lower by RMB 710 per tonne month-on-month. As of January 23, the ingot price was at RMB 14,100 per tonne before the Chinese New Year Holiday.

source https://www.alcircle.com/news/chinese-primary-aluminium-inventories-trending-higher-w-o-w-amidst-weaker-demand-in-compare-to-production-52178

Comments

Post a Comment