Economic downturn in many regions of the world, particularly in China, combined trade issues raised by the US, resulted in significant slow-down in aluminium demand in 2019. Contrary to our expectations at the beginning of the year, the demand growth was barely 0.5% in 2019, primarily due to weak demand from the automobile, building & construction sectors around the globe. The total aluminium usage across the world, comprising primary and recycled metal, was near stagnant at 88.1 million tonnes throughout the year.

Towards the year-end, however, the Chinese and the US Governments were moving towards a preliminary agreement, but lack of clarity on resolving the trade issues will leave the aluminium industry in some uncertainty, for at least, during the first half of 2020. While the long-term outlook of the aluminium industry remains optimistic, in the short run, there are no visible signs of recovery. The global economy in 2020 is expected, at best, to expand at 1.5% compared to 2.5% to 3.0% forecast previously. Accordingly, world aluminium usage is expected to grow by about 2.2% to reach about 90 million tonnes in 2020.

Now, let us look at the estimated projection on each vertical of the aluminium value chain in the rest of the year in terms of demand and supply, and also prices.

Bauxite

Resumption of full production at the Alunorte alumina refinery in Brazil and the production ramp-up at Al Taweelah alumina refinery in the UAE were some of the key influencers on the global bauxite market in 2019. Globally, the bauxite production was approximately at 347 million tonnes, which in 2020 is expected to reach 376 million tonnes. Australia continued to be the top bauxite producer in the world with a total estimated production of 99 million tonnes, up 5 per cent year-on-year. In 2020, Australia’s bauxite production is estimated to come in at 119 million tonnes, attributing to Amrun’s full production capacity at 23 million tonnes per annum and Bauxite Hills’ full production capacity of 6 million tonnes per annum.

Guinea is another key country influencing demand-supply situation across the world. Guinea’s bauxite production in 2019 was 69 million tonnes and with growing investments, it is expected to produce around 80 million tonnes in 2020.

China’s bauxite imports for the period January-November 2019 stood at 91.9 million tonnes, an increase of 21.9% from the same period during 2018. Dynamics of the supply scenario to China might get altered slightly due to Malaysia’s re-entry to bauxite mining & exports and Indonesia’s ban on export of bauxite which is likely to be brought forward from 2022 to 2020.

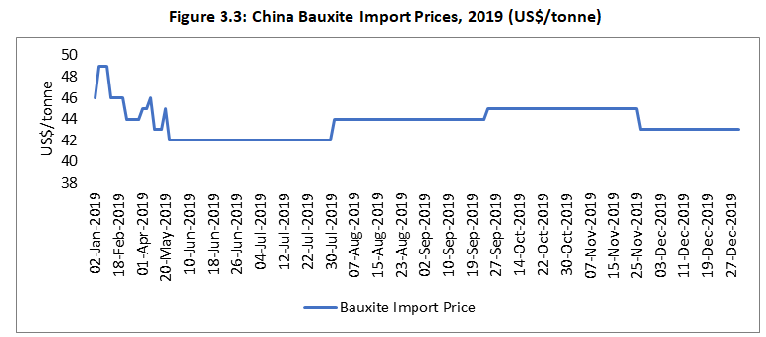

CIF China Australian Bauxite price started the New Year 2020 at US$ 43 per tonne, which as of the last week of February, remained the same with no intermittent rise or fall. The average import prices recorded in China last year were around US$ 43.7 per tonne, registering a drop from US$ 46.2 per tonne during 2018. The highest price was recorded in January 2019 when the average prices were around US$ 47.7 per tonne.

The average domestic price in the beginning of the year hovered at US$ 80 per tonne, which by the month-end grew to US$ 81 per tonne but again dipped to US$ 80 per tonnes, as of the end of February.

Alumina

The global alumina market in 2019 witnessed surplus supply, which in addition with lower demand from smelters, adversely impacted the price movement in the spot markets. In the short-term, alumina prices will continue to be under pressure due to excess supply and will be impacted by the demand across the aluminium value chain.

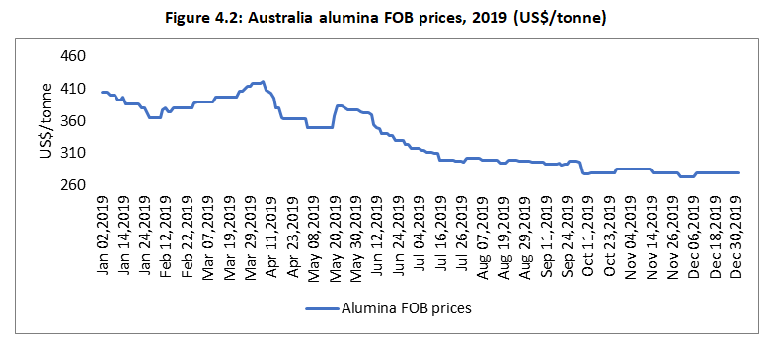

At the beginning of 2019, the monthly average Australian alumina FOB price was about US$ 405 per tonne and shot up to US$ 422 per tonne in April 2019. Since then, the prices have been constantly declining due to an oversupplied market. The price ended the year at US$ 279 per tonne, a decline of almost 45% since the start of 2019.

This show the alumina prices in 2019 failed to trade above US$ 300 per tonne since August 2019 and are likely to remain under pressure in 2020.

From the beginning of 2020 until now, the average Australian alumina FOB price hovered at US$ 285per tonne.

Some of the key factors that pushed the alumina prices down were due to excess production, with the resumption of Alunorte refinery and commencement of production at Al-Taweelah refinery in UAE. The price decline is also due to the slowing global aluminium demand with user industries underperforming during the entire 2019.

In China, according to Shanghai Metals Market, the average spot alumina prices started the year at US$ 428 per tonne and closed the year at US$ 349 per tonne. Since the beginning of 2020 until now, the average domestic sport alumina price stood at US$ 354 per tonne.

The total world alumina production in 2019 was approximately 132 million tonnes, an increase of 1.3% from 130 million tonnes in 2018. China in the year last produced 70.4 million tonnes of alumina, down 2.47% from 2018’s production of 72.1 million tonnes. For 2020, the production of the ore is expected to increase in China as new capacities are likely to come online during the year.

Australia, the second largest producer of alumina in the world produced around 20.1 million tonnes in 2018-19, a marginal decline from 20.3 million tonnes in 2017-18. However, the country, according to its government document, is forecast to produce a stable 20.2 million tonnes of alumina in 2019-20 and 2020-21.

Norsk Hydro, which produced 4.1 million tonnes of alumina during the 12-month period of 2019, is anticipated to achieve full capacity utilization by 2021.

In 2020, the production cost of alumina is expected to drop as there will be abundant supply of bauxite with majority of it coming from new projects in Guinea.

Australia in 2019 exported about 17.6 million tonnes. Australia expects to export around 17.9 million tonnes for the periods 2019-20 and 2020-21. China continued to be a net importer of alumina. The total volume of alumina imports into China for the period from January to November 2019 was 1.24 million tonnes.

The Qiya Aluminium Group’s 2.4 million tonnes per year Qiya Linfen alumina refinery is expected to commence production in 2020. Chalco’s proposed refinery with a capacity of 2 million tonnes in Guangxi is also expected to be operational by June 2020.

The outlook for 2020 would be surplus of alumina from expansions and potential lower demand for aluminium across the world. Supply is expected to outrun demand in 2020, pushing down the alumina prices.

Primary Aluminium

During the 1st half of 2019, global demand for primary aluminium was stagnant while supply of aluminium increased owing to resumed capacities and new capacities coming on stream. With the US withdrawing its sanctions on RUSAL and relatively less impact on Hydro’s aluminium production in Brazil added to the global production. The mismatch in demand-supply supplemented by other negative factors affected the international aluminium price, which resulted in LME price falling from US$ 1,846 per tonne in January 2019 to US$ 1,770 per tonne in December 2019. Keeping in view the new capacities coming up in China and Middle East, aluminium is likely to be in surplus during 2020 and prices may continue to be under pressure.

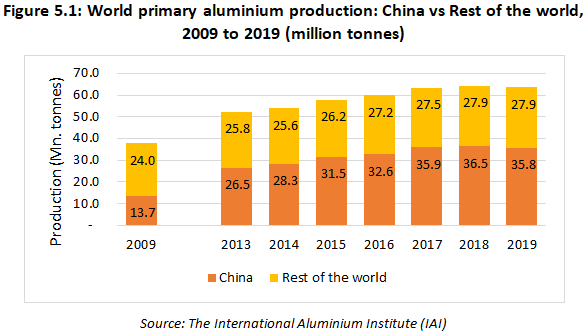

Global primary aluminium production in 2019 stood at around 63.7 million tonnes as against 64.3 million tonnes in 2018. Going forward, the production of primary aluminium is likely to increase during 2020, given new investments and expansions in primary metal market and surplus supply of alumina. But In line with these developments, volatility in aluminium prices in the short-term cannot be ruled out.

In China, primary aluminium production was 35.6 million tonnes in 2019, a decrease of 2.3% over the previous year. However, situation is improving gradually. Around 1.99 million tonnes new capacity has been launched recently, taking total production capacity of primary aluminium in the country to 40.69 million tonnes.

The global demand for aluminium in 2020 is likely to be moderate and is expected to grow by about 2.2%. The year 2020 may witness surplus with restarting of primary aluminium production in Canada and Brazil, capacity advancement in Bahrain, commissioning of SALCO’s 300,000 tonnes greenfield smelter, restart of Xinfra in China, and new green aluminium industrial park coming up at Yunnan. The metal price is expected to hover around an average of US $ 1,750 to 1900 per tonne during 2020.

Downstream Aluminium

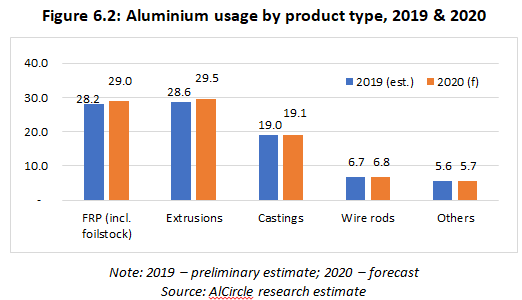

During 2020, the aluminium usage in transportation sector is expected to derive much of its growth from increasing usage of aluminium automotive sheet applications. While the automobile production is expected to be under pressure due to slow down in global economy, the demand for aluminium FRP from the transportation applications is expected to grow on the back of increasing demand to produce light weight vehicles with increased fuel efficiency and confirming to stringent environmental and safety standards. Worldwide aluminium flat rolled product usage in 2020 is expected to grow at about 2.9% to reach 29 million tonnes, in contrast to 28.2 million tonnes in 2019.

To meet the growing usage, Rusal is investing US$ 200 million in Kentucky aluminium alloy and rolled aluminium producer Braidy Industries. Rusal’s investment is expected to fund a new aluminium rolling mill in Eastern Kentucky. Novelis’s new Guthrie, Kentucky rolling facility which is under construction is expected to be operational during 2020. This facility will have a rolling capacity of 200,000 TPA and will cater to the automotive industry.

Packaging sector, the largest end user sector of aluminium FRP, on the other hand, is expected to grow at around 3% during 2020, aided by policies such as Extended Producer Responsibility. Also, aluminium beverage cans are expected to drive the demand for aluminium can stock in the coming years.

Aluminium foil usage, which was at 5.4 million tonnes in 2019, is also forecast to grow at 2.4% during 2020 to reach 5.5 million tonnes. China and the emerging markets are expected to drive the global foil demand during this period. Amidst trade barriers in the US, the Chinese company Mingtai Aluminium has reportedly set up an entity called Gwangyang Aluminium Industrial Area in Korea and has plans to invest an estimated US$ 35.2 million to produce 20,000 tonnes of aluminium foil annually.

National Aluminium Company Limited (Nalco), India, also has plans to set up aluminium foil manufacturing unit at Kamakshyanagar in Odisha to meet the challenges of providing alternative solutions to the packaging industry, while American flat-rolled aluminium producer JW Aluminum plans to invest US$ 32.8 million in a project to optimise its equipment at its Goose Creek, South Carolina, for the production of aluminium foil.

Aluminium extrusions usage is forecast to grow at around 3% to reach 29.5 million tonnes, while aluminium wire rod usage to grow marginally by about 0.7% in 2020.

End Users

The aluminium industry in the year last faced several hurdles such as slowdown in global economy and automobile industry, trade war between the US and China and proposed Brexit, which is likely to be implemented by early 2020. Economic slowdown depressed the automobile industry especially in China and India, while trade barriers resulted in imbalance of aluminium prices. However, these developments are perceived to be a temporary phenomenon and the aluminium industry is likely to revert to its growth mode in the near future.

On the positive side, automobile industry is witnessing a paradigm shift and is embracing new technology innovation. Apart from reducing the vehicle curb weight in view of reducing carbon emission, some of the key trends prevailing in the industry include electrification (EVs), connected cars (IOT), new regulations and macro-economic factors. As part of reducing the curb weight of ICE vehicles, usage of aluminium in new vehicles is increasing year-on-year in the US and European markets. The aluminium content per vehicle in Europe stood at around 179 Kg in 2019 and is expected to increase to 198.8 kg by 2025.

But amidst the global economy downturn, short-term outlook for the aluminium market from passenger cars and LCVs will almost be stagnant in 2020. However, in the mid-term, the demand for aluminium is likely to improve for the production of EVs, as planned by global majors.

Aluminium usage in electrical and electronics applications is also expected to record a rise, although marginally from 11.7 million tonnes in 2019 to 11.9 million tonnes in 2020.

Recycled Aluminium

The world is witnessing adoption of green climate reforms from all possible avenues, like never before, to address the global warming. Accordingly, many countries are making required amendments to reduce greenhouse gas emission and to increase the use of green energy solutions. In line with this movement, importance of using materials that are recyclable has gained momentum over the last decade. So, aluminium with its unique property of 100% recyclability has changed the dynamics of the industry and recycled aluminium production accounts for around 29% of the total production of aluminium in the world.

But like the primary aluminium market, recycled aluminium market is also under pressure since mid-2018, owing to the slowdown in automobile industry, trade barriers and volatile prices. China’s restriction on aluminium scrap import quota to 1.2 million tonnes for 2019 along with the ongoing trade war between the US and China has resulted in surplus stock. This trend is likely to spill over to 2020 as well, as China’s restriction on aluminium scrap import quota for 2020 has been down-sized to 283,041 tonnes.

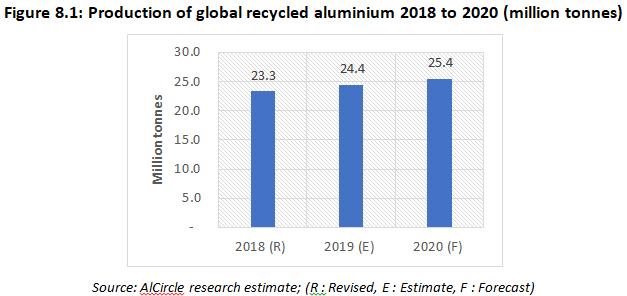

In 2019, recycled aluminium was estimated at 24.4 million tonnes. The stagnation of the market is likely to spill over to the first half of 2020 and the production is likely to improve marginally to reach 25.4 million tonnes in 2020.

While the short-term outlook appears to be grim, increasing trend in the usage of recycled aluminium across user industries indicates better days ahead. Novelis plans to invest US$ 36 million to advance the recycling capacity at its Greensboro facility in the US and the construction is likely to be complete by mid-2021. JW Aluminium is investing US$ 255 million in enhancing its recycling capacity at its plant in South Carolina.

Demand for recycled aluminium is increasing steadily in India and new investments are being made by Hindalco and Japan-based Daiki in improving production of secondary aluminium. With an investment of INR 2.5 billion, Daiki Aluminium Industry India Private Ltd., is setting up a plant with capacity to produce 84,000 tonne of aluminium alloy ingots per annum and the plant is likely to be operational by February 2020.

source https://www.alcircle.com/news/alcircle-global-aluminium-industry-outlook-2020-51172

Comments

Post a Comment