The US dollar weakened last Friday as optimism about the outlook for a US-China trade deal lifted risk appetite of investors. The dollar index, which tracks the greenback against a basket of other currencies, fell 0.7% and finished at 97.01. LME base metals increased after a two-day closure for the Christmas holiday. LME aluminium gained 0.25% and SHFE aluminium grew 0.57%.

Lower inventories continued to buoy three-month LME aluminium, which extended a price rally and closed up 0.25% at US$1,823.5 per tonne last Friday night. LME aluminium is likely to trade at US$1,800-1,840 per tonne.

As on December 27, Friday, LME aluminium cash (bid) price stood at US$ 1788 per tonne, LME official settlement price stands at US$ 1789 per tonne; 3-months bid price stands at US$ 1814.5 per tonne, 3-months offer price is US$ 1816.5 per tonne; Dec 20 bid price stands at US$ 1870 per tonne, and Dec 20 offer price stands at US$ 1875 per tonne.

The LME aluminium opening stock decreased to1483625 tonnes. Live Warrants totalled at 927300 tonnes, and Cancelled Warrants were 556325 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1810 per tonne.

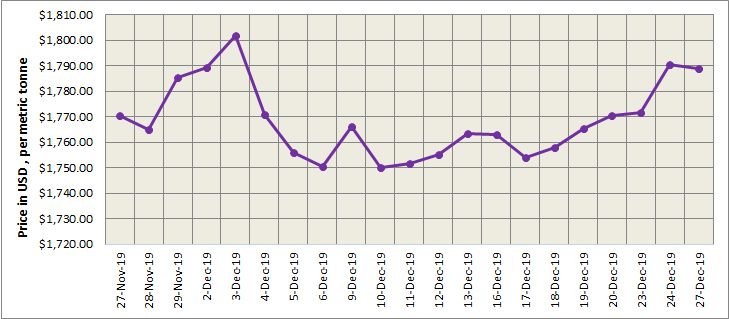

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) increased to US$2051 per tonne on Monday, 30 December 2019.

The most traded SHFE 2002 contract resided around one-week lows, and ended the day at RMB14,075 per tonne. The most-traded SHFE 2002 contract gained 0.46% on the day and finished at RMB14,145 per tonne on the back of short-covering. The contract is expected to trade at RMB 14,000-14,250 per tonne today.

source https://www.alcircle.com/news/lme-aluminium-opened-lower-after-christmas-holiday-shfe-aluminium-shed-04-49713

Comments

Post a Comment