LME aluminium regained losses on Wednesday; SHFE aluminium traded weaker on expectation of rising capacity

The US dollar rose on Wednesday against a basket of other currencies, as traders monitored stronger-than-forecast economic data and fresh developments in the US-China trade war. LME base metals closed mixed on Wednesday. Aluminium rose 0.7%. The SHFE complex also saw mixed performance overnight. Aluminium nudged up 0.1%.

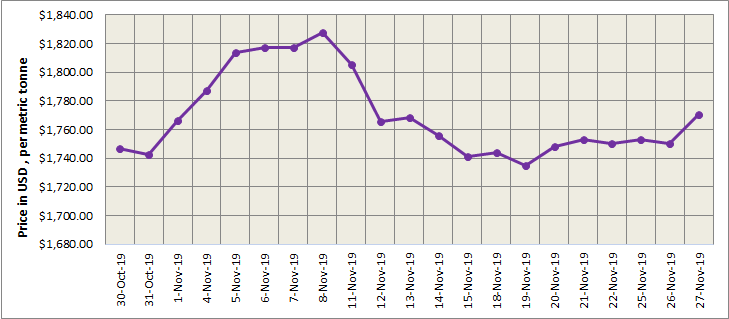

Three-month LME aluminium advanced 0.68% to end at US$1,772 per tonne on Wednesday, buoyed by positive economic data. It is expected to trade rangebound between US$1,755-1,770 per tonne today.

As on November 27, Wednesday, LME aluminium cash (bid) price stood at US$ 1770 per tonne, LME official settlement price stands at US$ 1770.50 per tonne; 3-months bid price stands at US$ 1760 per tonne, 3-months offer price is US$ 1761per tonne; Dec 20 bid price stands at US$ 1822 per tonne, and Dec 20 offer price stands at US$ 1827 per tonne.

The LME aluminium opening stock dropped slightly to 1228325 tonnes. Live Warrants totalled at 1063425 tonnes, and Cancelled Warrants were 164900 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1760 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) remains unchanged at US$ 2005 per tonne today November 28, 2019.

The most-liquid SHFE 2001 contract slid for the fourth consecutive session yesterday, weighed by lower costs, smaller drops in inventories and expectations of greater capacity in operation. The contract lost 0.22% on the day and finished at RMB 13,735 per tonne. The SHFE 2001 contract climbed to a session-high of RMB 13,780 per tonne in early trade overnight, before it gave back much of those gains to close 0.11% higher at RMB 13,750 per tonne. Shandong Weiqiao’s plan to move about 2 million tonnes of capacity from Shandong to Yunnan is likely to help ease supply pressure in the first half of 2020 and may support SHFE aluminium in the short term, but prices remain bearish from a longer-term perspective. The SHFE 2001 contract is expected to move between RMB 13,700-13,800 per tonne today, with spot premiums of RMB 90-130 per tonne over the SHFE 1912 contract.

source https://www.alcircle.com/news/lme-aluminium-regained-losses-on-wednesday-shfe-aluminium-traded-weaker-on-expectation-of-rising-capacity-49493

Comments

Post a Comment